|

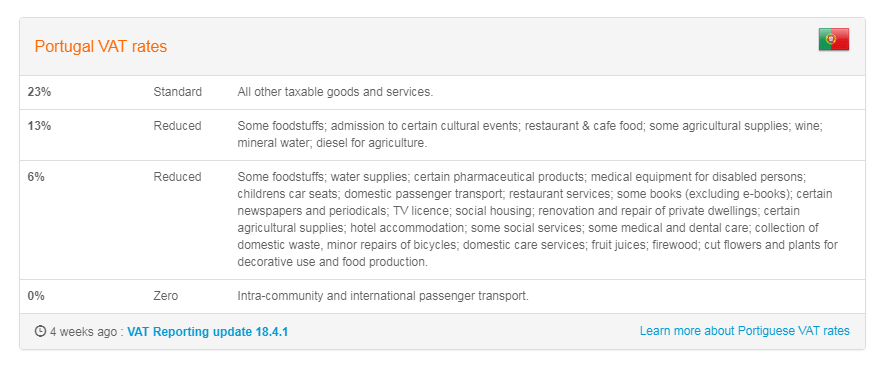

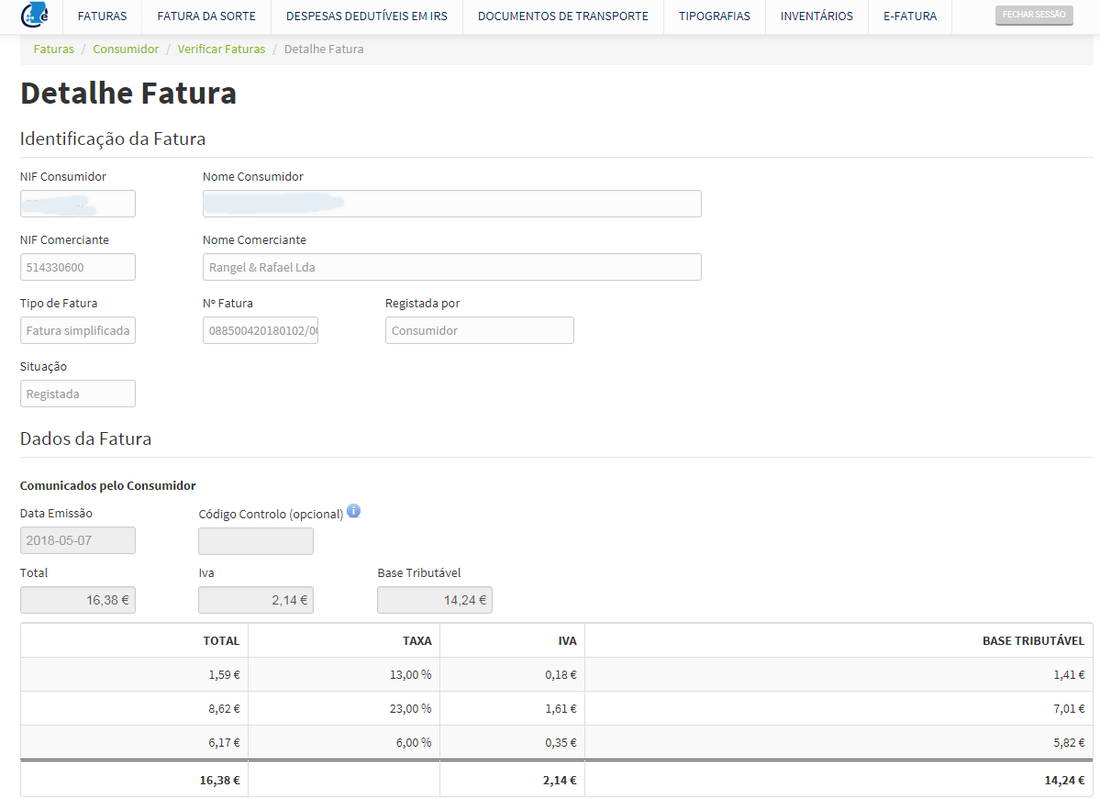

If you’re planning to become a resident of Portugal, one of the first things on your To Do list is to obtain a Número de Identificação Fiscal or NIF (nēf). Almost any activity that has taxes associated with it will require this nine-digit number: opening a bank account, renting an apartment, purchasing property, establishing utilities, taking out a loan, obtaining a residency permit, or even making everyday purchases. Getting a NIF is straight forward, even prior to moving to Portugal. The main complication for non-EU residents is that it requires a Fiscal Representative who lives in Portugal. This is usually your lawyer, or a friend or relative, someone who will to receive any mail on your behalf from the tax office (Finanças) and be able to notify you if there is a problem. However, that Fiscal Representative will be on the hook if you don’t pay your taxes, so don't feel bad if your best (Portuguese) friend balks at task. Some people want to skip this step by using an in-country address instead of appointing a Fiscal Representative, acting as if you’re already living here. That’s not smart for a number of reasons. Making false statements to government authorities can be a serious matter and might get you expelled from Portugal if you’re caught. Being kicked out of an EU country means you can be barred from the entire European Union. The likelihood is low, but it is not worth the risk to save a couple hundred bucks. Our immigration attorney was our Fiscal Representative and she also obtained our NIFs, so I don't have details on how that was accomplished. Others have reported a rather simple procedure as long as you have your passport, verification of your (foreign) address such as a utility bill, and the full details of your Portuguese Fiscal representative (if your current address is outside of the EU.) Once you receive your Temporary Residence Permit – this is the next step after your Residency Visa – you can return to Finanças and give them your Portuguese address. At that point they will remove the Fiscal Representative from your records as that person is no longer needed. And at this point is when you begin to keep track of the sales taxes you pay. How do you do that? Read on. "Número de Contribuente?" is what a clerk might ask when you are paying for an item, large or small. This is a request to find out if you would like a tax receipt that includes your NIF. This seems like a strange thing for a €15 bill at the grocery store, but it was actually part of the reason for the economic turnaround in Portugal. Before the laws were changed it was almost unknown for the proper amount of value added taxes to be paid. In Portugal, those taxes (IVA – imposto sobre o valor acrescentado) range from 6-23% depending on the item. (Meats, produce and such are 6% while beer, wine and prepared foods are 23%). The country is still a cash-driven society so it was quite easy for taxes not to be reported and paid to the government. To curb this abuse, laws were enacted that required the end user (you) to verify that those taxes have been paid and there are fines between €75 and €1000 if you cannot produce a receipt for your purchases that include your NIF. The internet is full of stories about someone overhearing someone else talking about an 85 year old lady who didn't have a tax receipt for her package of noodles and had to pay a hefty fine. These unverified reports often elicit vitriolic comments about the Portuguese tax authorities. The reality is that these types of enforcement measures are really not needed. Once you sign up and receive your NIF and register with Finançis, you verify (online) all the purchases for which you supplied your NIF. It is even possible to add a receipt (fatura) even if the clerk failed to take your NIF when you made a purchase. Why go to the effort? Here’s where the Portuguese authorities are smart: If you track your purchases, and enter those receipts for which a NIF wasn't supplied, those registered amounts do two things: First, you’ll receive an entry into a lottery for various prizes (including a new car) based on the amount of taxes you report. Also, depending on your income tax status, at the end of the year you can take money off the amount due just because you kept track of the IVA paid to those various vendors. This system has proven to be a resourceful method for the tax authorities to ensure the monies have been paid and government revenues have soared accordingly. Those revenues help fund universal healthcare, mass transit, etc. Because of this, one of the key things you will do when you live in Portugal is to memorize your NIF. Because believe me, you’re going to use it. Comments are closed.

|

Your HostsHarold is a former software engineer. Jana is an author. Together they're exploring their new life in Portugal. Archives

December 2022

Categories

All

|

RSS Feed

RSS Feed